Alabama Recent DSCR Fundings

Real Investments. Real Results.

Real estate investors in the Yellowhammer State are turning to DSCR Loans as a strategic tool to expand and manage their investment property portfolios. DSCR loans allow investors to secure financing based on the property's ability to generate income (rather than an investor's individual credit profile). In a market like Alabama, where real estate prices have shown steady growth and rental demand remains steady, DSCR loans offer investors a flexible and effective means to acquire new properties, improve existing ones, or refinance their assets. Easy Street Capital is proud to be a leading provider of DSCR loans for Alabama real estate investors looking to build rental portfolios! Check out our most recently funded DSCR loans in Alabama below:

Duplex

Tuscaloosa, AL

$112,500 Alabama DSCR Rental Loan for a Cash-Out Refinance of a rental property in Tuscaloosa. The property is fully occupied on long-term leases and is located only a few minutes away from the center of Tuscaloosa, allowing easy access to the city’s conveniences while enjoying the calmness of the suburbs.

Duplex

Montgomery, AL

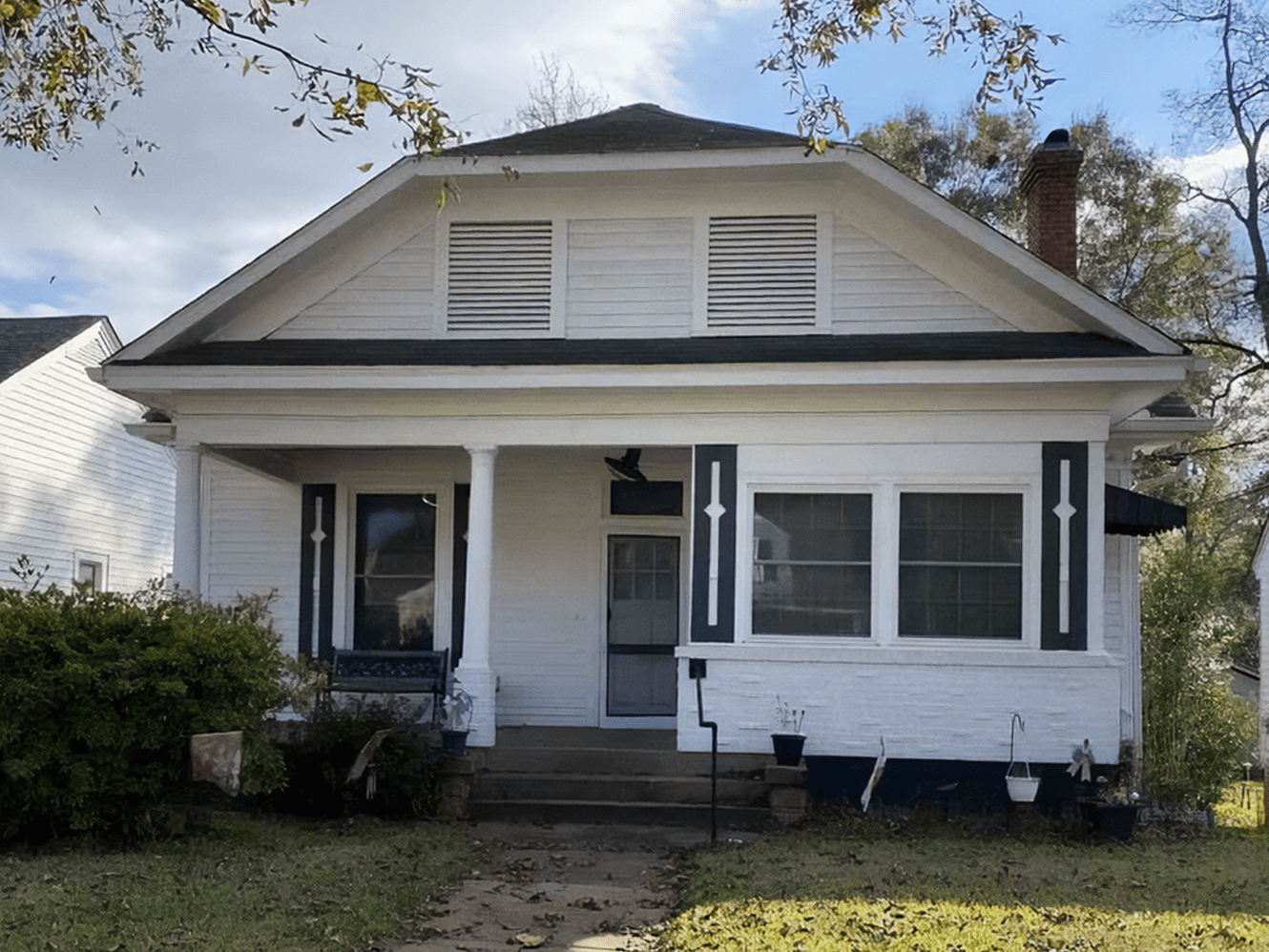

$75,000 Alabama DSCR Rental Loan for an Acquisition of a rental property in Montgomery. Featuring two units of varying size, this duplex was built in 1925 and has an effective age of 30 years due to its adequate maintenance. The property will be utilized as a long-term rental upon acquisition.

Duplex

Tuscaloosa, AL

$132,000 Alabama DSCR Rental Loan for a Cash-Out Refinance of a rental property in Tuscaloosa. In the heart of Tuscaloosa, The University of Alabama, attracts students nationwide making this a hotspot for savvy investors.

Single-Family Residence

Huntsville, AL

$143,500 Alabama DSCR Rental Loan for an Acquisition of a rental property in Huntsville. This contemporarily designed property showcases new luxury vinyl tile flooring, along with a new roof, vinyl windows, and water heater. Not to mention the sleek updated bathrooms with black finishes and a remodeled kitchen with stainless steel appliances, granite cabinets, and a subway tile backsplash. The backyard is also large enough to add a pool, for now, the porch on the side of the house offers great shade to escape the Alabama heat.

Apply Today

Take the next step in your investment journey with a trusted, reliable lender that has your best interest in mind. Get in touch or request a quote today.