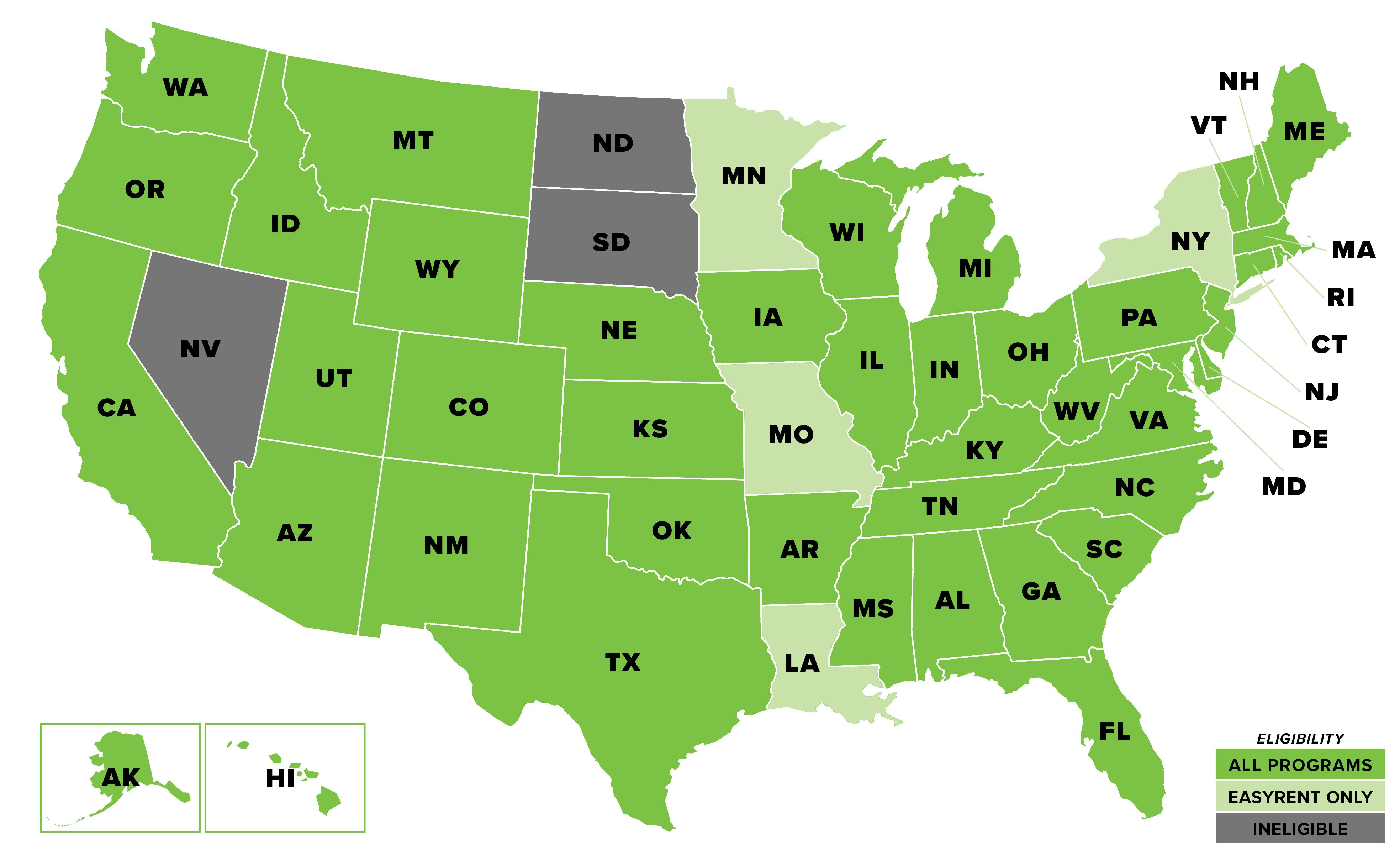

Where We Lend

Easy Street Capital is a nationwide private mortgage lender serving real estate investors of all stripes. Our innovative financing solutions - EasyFix, EasyRent, and EasyBuild - help real estate investors of all experience levels and specialties achieve their investment goals. Easy Street Capital's industry-leading loan programs are tailored to meet the needs of investors using a variety of different strategies - from fix and flip loans, to the BRRRR Method, to short term rentals (and everything in between).

Learn more about our lending geographies by clicking on either the interactive map or list of states below. Eligibility requirements differ slightly between our three lending programs. If you have any questions, or if you cannot find the information you are looking for, please click the button below and our team will be in touch as soon as possible!

Where We Lend - Simplified List

Duplex

Worcester, MA

$712,500 Massachusetts DSCR Rental Loan for a Rate-Term Refinance of a rental property in Worcester. This fully occupied residence is conveniently close to major routes, shopping, employment opportunities, public services, and schools.

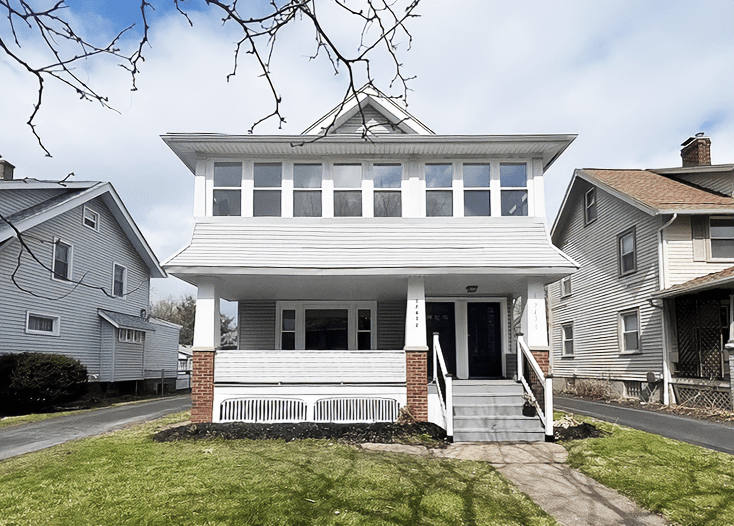

Single-Family Residence

Bend, OR

$295,000 Oregon DSCR Rental Loan for a Cash-Out Refinance of a rental property in Bend. Following its acquisition, the property underwent extensive renovations, including but not limited to drywall work, deck construction, the installation of cabinets and marble countertops, and more.

Triplex

Lakewood, OH

$337,500 Ohio DSCR Rental Loan for an Acquisition of a rental property in Lakewood. This property is situated in the heart of western Lakewood and is within walking distance to schools, an award wining library, retail shops, and Lake Erie.