North Carolina DSCR Loans

EasyRent is our tailored and industry-leading DSCR Loan solution for North Carolina real estate investors. Whether you are acquiring property to expand your portfolio or cashing out your capital in a refinance, we have a loan for you. Our DSCR Lending Program has solutions for anyone – from first-time investors to industry veterans looking to rapidly scale their portfolios. We are confident we can find you a great North Carolina DSCR loan in a quick, efficient and easy process. Click the button below and get started today!

Need a DSCR Loan in North Carolina?

Got any questions?

North Carolina Recent DSCR Fundings

Real Investments. Real Results.

Real estate investors in the Tarheel State are turning to DSCR Loans as a strategic tool to expand and manage their investment property portfolios. DSCR loans allow investors to secure financing based on the property's ability to generate income (rather than an investor's individual credit profile). In a market like North Carolina, where real estate prices have shown steady growth and rental demand remains steady, DSCR loans offer investors a flexible and effective means to acquire new properties, improve existing ones, or refinance their assets. Easy Street Capital is proud to be a leading provider of DSCR loans for North Carolina real estate investors looking to build rental portfolios! Check out our most recently funded DSCR loans in the Tarheel State below:

Single-Family Residence

Emerald Isle, NC

$1,193,000 North Carolina DSCR Rental Loan for an Acquisition of a rental property in Emerald Isle. This brand-new three-story oceanfront short-term rental property boasts seven bedrooms, four and a half bathrooms, two garages, over 1,000 square feet of covered decks and porches, an in-ground pool, and breathtaking views of the Atlantic Ocean.

Single-Family Residence

Wilmington, NC

$496,000 North Carolina DSCR Rental Loan for an Acquisition of a rental property in Wilmington. Sitting mere miles from the coast line, this property is situated perfectly amidst the area’s retail amenities, airport and beaches.

Single-Family Residence

North Topsail Beach, NC

$316,000 North Carolina DSCR Rental Loan for an Acquisition of a rental property in North Topsail Beach. With a front and back porch, the property overlooks an expansive coastal scene, as well as 360 degrees of green grass in the yard. Quintessential to beach town neighborhoods, the house sits on stilts raised above the ground, with a carport beneath and an outdoor shower to the side.

Single-Family Residence

Fletcher, NC

$904,800 North Carolina DSCR Rental Loan for a Cash-Out Refinance of a rental property in Fletcher. Situated on over 4 acres, the two-story back deck provides gorgeous mountain views to wind down and watch the sunset. This short-term rental also boasts hardwood floors that are perfectly paired with the warmth of the gas fireplace.

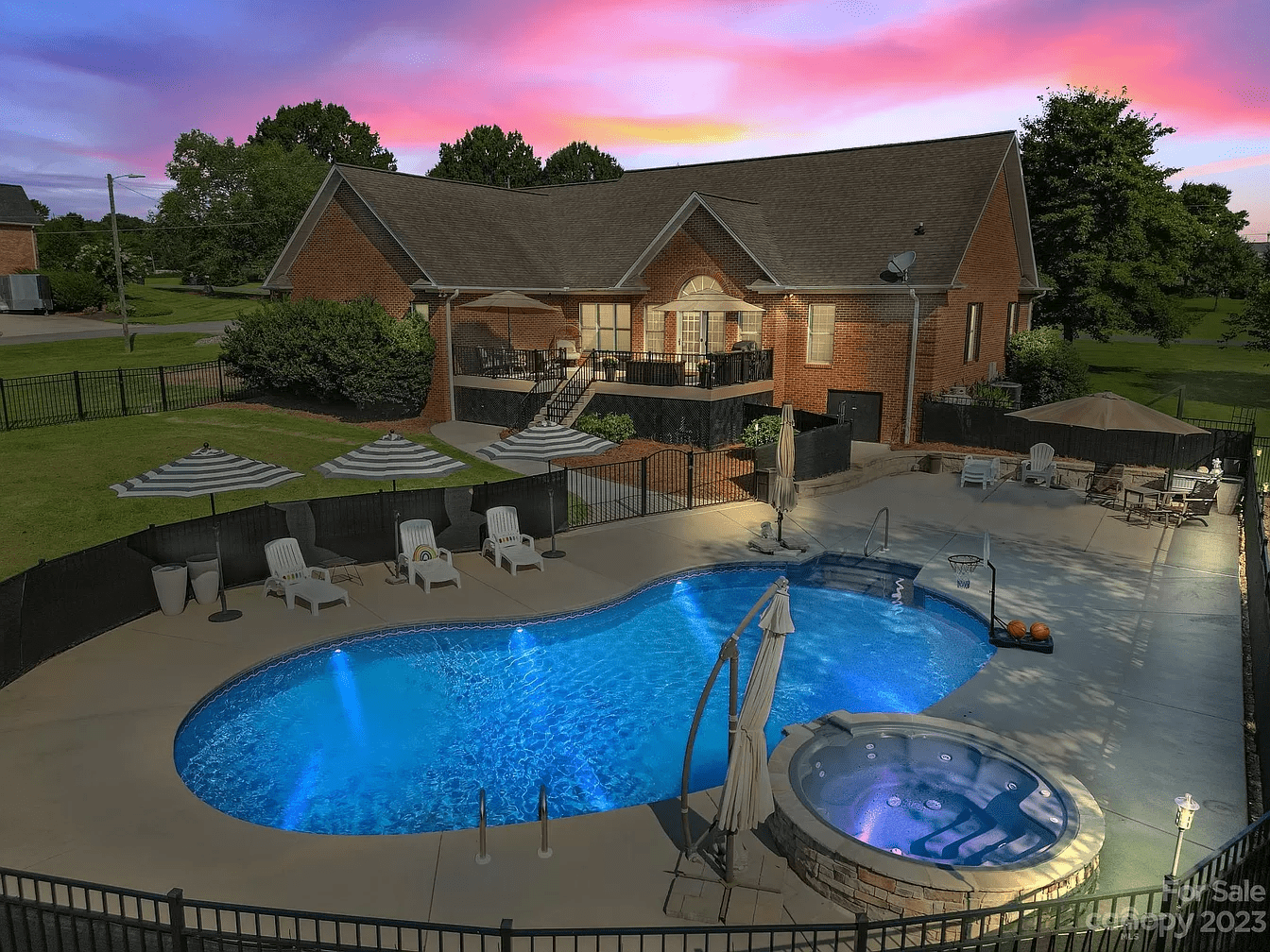

Single-Family Residence

Statesville, NC

$290,000 North Carolina DSCR Rental Loan for an Acquisition of a rental property in Statesville. This property offers comfortable living with a recently updated deck and a stunning inground pool complete with a heated spa, turning the backyard into a private oasis. The retreat resides in a neighborhood known for its blend of manufactured and stick-built homes, showcasing exceptional construction and workmanship.

Single-Family Residence

Oak Island, NC

$521,250 North Carolina DSCR Rental Loan for a Cash-Out Refinance of a rental property in Oak Island. With three bedrooms and two bathrooms, the modern layout is designed for comfortable coastal living with a well-appointed open deck providing direct Atlantic beach access. Part of North Carolina’s Brunswick Islands, Oak Island provides a tranquil escape with the local real estate market characterized by several resort communities.

PUD

Newport, NC

$241,867 North Carolina DSCR Rental Loan for an Acquisition of a rental property in Newport. Consisting of three bedrooms and two bathrooms it is in great condition and features granite countertops, stainless steel appliances, and modern finishes. The property is in close proximity to many tourist attractions such as Emerald Isle, the Croatan National Forest, and beach access to the Atlantic Ocean.

Single-Family Residence

Fayetteville, NC

$131,250 North Carolina DSCR Rental Loan for a Rate-Term Refinance of a rental property in Fayetteville. The property features two bedrooms and one bathroom, and many recent updates. The kitchen has been updated with new cabinets, countertops, a new sink and tile backsplash, and the bathroom has a new vanity, toilet, and tub. The house has also been freshly power washed and painted, with new flooring and a new roof installed since it was purchased..

Single-Family Residence

Wilmington, NC

$305,250 North Carolina DSCR Rental Loan for a Cash-Out Refinance for a rental property in Wilmington. Located in North Wilmington, there is no shortage of local amenities such as retail, recreational, schools, healthcare, and more. Further, the home is roughly a 15-minute drive from the sandy beaches with Wrightsville Beach being the closest.

Apply Today

Take the next step in your investment journey with a trusted, reliable lender that has your best interest in mind. Get in touch or request a quote today.