DSCR Loans

In recent years, a fairly new loan product called “DSCR Loans” (DSCR stands for “Debt Service Coverage Ratio) has become enormously popular with real estate investors; many of which have been able to achieve dreams of financial freedom through rental properties. DSCR Loans have been the number one tool these investors have utilized.

These loans, meant specifically for investment properties only, are so effective and popular because they require no income verification (or DTI – Debt-To-Income Ratio) and no tax returns or endless paperwork. Further – while the qualification and documentation is much less than conventional mortgages – the interest rates are just barely higher (typically less than 1% more). These loans offer fixed rates for 30 years (including options where its interest-only for the first 10!), so you avoid the payoff and refinance pressure that often comes with hard money alternatives.

Put together, its no wonder why investors have flocked to these loans to scale their portfolios and achieve their dreams of financial freedom.

How Do I Qualify?

Potential Borrowers can sometimes encounter confusion when first learning about DSCR loans, specifically the qualification process, especially if they have been in the wringer with a conventional qualification. While conventional lenders will scrutinize seemingly every aspect of your income, expenses, bank account transactions and credit history – DSCR loans are different, the qualification and underwriting is primarily focused on the property instead of you, the borrower.

DSCR lenders look at your credit score and make sure you have a few months of payments in the bank. But other than that your property qualifies, not you! That means your income sources, whether you have a W-2 job, own a business, invest in real estate full time or are retired or between jobs, don’t matter! DSCR lenders strictly do not take income into account!

What Determines my Rate and Terms?

So what does determine if you qualify and what rate you will pay? It primarily comes from three key factors:

- DSCR (Debt-Service-Coverage-Ratio)

- LTV (Loan-To-Value Ratio)

- FICO (Credit Score)

DSCR (Debt Service Coverage Ratio)

It’s no surprise that the “DSCR” metric is important for DSCR Loans, it’s right there in the name! DSCR stands for “Debt-Service-Coverage-Ratio” and measures the income from the property (rents) divided by the main expenses of the property (principal and interest on your mortgage loan, plus property taxes, insurance, and any applicable HOA dues).

Real estate investors generally invest for monthly cash flow from their rental properties, or so their rents (income) exceed their expenses, and they have cash (profit) left over. A DSCR of 1.00x means that income equals expenses so that the investor is breaking even, a DSCR above 1.00x means the investor is making money (cash flow). For example, a DSCR of 1.25x would occur if the property earns $1,250 per month in rent and has $1,000 in PITIA (expense – or principal + interest + taxes + insurance + association dues). A DSCR below 1.00x means that expenses exceed income, so the investor is losing cash flow every month.

How does this work from the Lender’s perspective? A lender will generally want the investor to make the most cash flow possible, because the primary concern is ability to make payments on the mortgage loan. Therefore, the higher the DSCR, the better lending terms an investor will get, because the lender can be more confident of getting paid back as rents more than cover the debt payments each month!

LTV (Loan-To-Value Ratio)

The second of the two all-important ratios is LTV or “Loan-to-Value.” This is a simple metric comparing your loan amount to the value of the property. This is extremely important for the lender because the lender’s main recourse if you stop paying (default) on the loan is to foreclose on the property and replace the money lost on the unpaid debt with the real estate asset. Simply, if the lender can sell the property for more than what is owed in a foreclosure situation, then the lender is protected from losing any money.

As such, the lower the LTV, the lower the risk of loss is to the lender. They have a larger “cushion” in case foreclosure is needed.

LTV Example

For example, in an 80% LTV scenario (say, a borrower purchases a property and puts 20% down), a $1,000,000 property would carry a $800,000 loan, with a $200,000 “cushion” or equity for the borrower. In this situation, if the borrower defaults and the lender needs to foreclose, as long as the property hasn’t declined in value by more than the 20% ($200,000), the lender is protected against the risk of loss, since they would then own a property worth more than the canceled debt.

In this example, if the property maintained this value of $1,000,000 and the lender foreclosed due to default, the lender actually comes out ahead(!), owning a $1,000,000 property instead of a $800,000 note. However, in the real world, it’s not so simple (as all real estate investors know very well!), as there are closing costs, legal fees, and time and energy spent in this process that nearly all lenders would prefer to avoid (instead, sticking to their core business of providing loans to successful and thriving investors!).

So how does this affect borrowing terms? Simply, the lower the LTV, the better the terms for the borrower, as it increases the “cushion” for the lender in the case of value declines and foreclosure. In the above example, the value of the property would have had to decrease more than 20% for the lender to lose money, an unlikely but plausible scenario. However, if the LTV had been 60% (i.e. $600,000 loan on a $1,000,000 property), the value would have had to decrease by a whopping 40% or $400,000 for the lender to be in a loss position. Much more unlikely! Thus, the lender can offer better terms (lower rate for example) on the 60% LTV loan as it is much less risk.

FICO (Credit Score)

The final key metric towards qualifying for a DSCR loan is your FICO or qualifying credit score. Typically, there are three credit scores for each individual (from the three main credit bureaus – Equifax, Experian, and TransUnion) and the score used for qualifying the loan will be the middle one.

While DSCR loans are primarily based on the property rather than the individual borrower (i.e. no DTI calculated), the lender is still looking at credit score as part of the big picture of qualification. Mortgage Lenders calculate credit scores little differently than the score from a normal bank or online data provider. These scores are weighted a bit more heavily towards real estate credit, and take other mortgage debt more into account.

From the lender’s perspective – someone with a long and great history of timely and full payments on other mortgages are a great indicator of likelihood of perfect and timely payments on your DSCR Loan – so better the credit, better the terms.

Other Factors

The “big three” metrics listed above (LTV, DSCR, FICO) are the main determinants for your qualification and rate. But other factors make a difference as well, albeit not quite as important. Some other factors that DSCR lenders utilize include:

- Loan Purpose: Typically, you will get better terms on an acquisition than a cash-out refinance, as the value utilized by the lender is more certain on a purchase and there’s more guaranteed “skin in the game” for the borrower.

- Loan Size: DSCR lenders typically like a “Goldilocks sweet spot” loan size, not too big and not too small for the best pricing. This is because there’s less of a market for supersized rental properties. How many potential buyers or renters are there for $3M+ mansions? B too small value property (worth $200k or less) may indicate a declining or ultra-rural market, a rough neighborhood or a property in poor condition. Best rates and lowest fees typically come in the $250k – $750k loan amount range.

- Prepayment Penalties: DSCR lenders are known for giving the best rates when penalties to prepay the loan (i.e. a fee if you prepay early in the term) are higher. If you are a long time-horizon investor and don’t plan on selling quickly, its often a good idea to trade prepay penalties within the first five years for a much lower rate.

How To Pick a DSCR Lender

Once you are ready to take out a DSCR Loan – it’s time to pick the Lender that’s right for you. It can be sometimes overwhelming on how to start and who to pick. There are lots of DSCR lenders out there offering the product.

Here’s the secret about DSCR Loans that not a lot of lenders will tell you: the loan product is mostly the same among all the lenders. While there are some differences along the edges and with exact interest rates, most of the time the loans are more or less the same. And when it comes to rates, one lender may have the best rates at a given time. But as all competitive markets, it won’t last for long, and rates will eventually converge to essentially the same.

So how do you pick the right DSCR lender? not just for your immediate deal, but for establishing a long-term relationship?

You are going to want to hone in on the true specialties and differences in loan programs offered. And of course the reputation and financial strength of the lender as well. Rates and Fees are likely to end up being pretty similar so make sure to ask good questions and find out why they are different.

Why is Easy Street Capital the Best DSCR Lender?:

Direct Lender Easy Street Capital is a direct lender meaning we lend our own capital with our own skin in the game. Many DSCR lenders out there are actually intermediaries, collecting a fee to match you with a lender. Some brokerages are quality and are worthwhile and can get you the best terms when shopping. But oftentimes its best to go straight to the source!

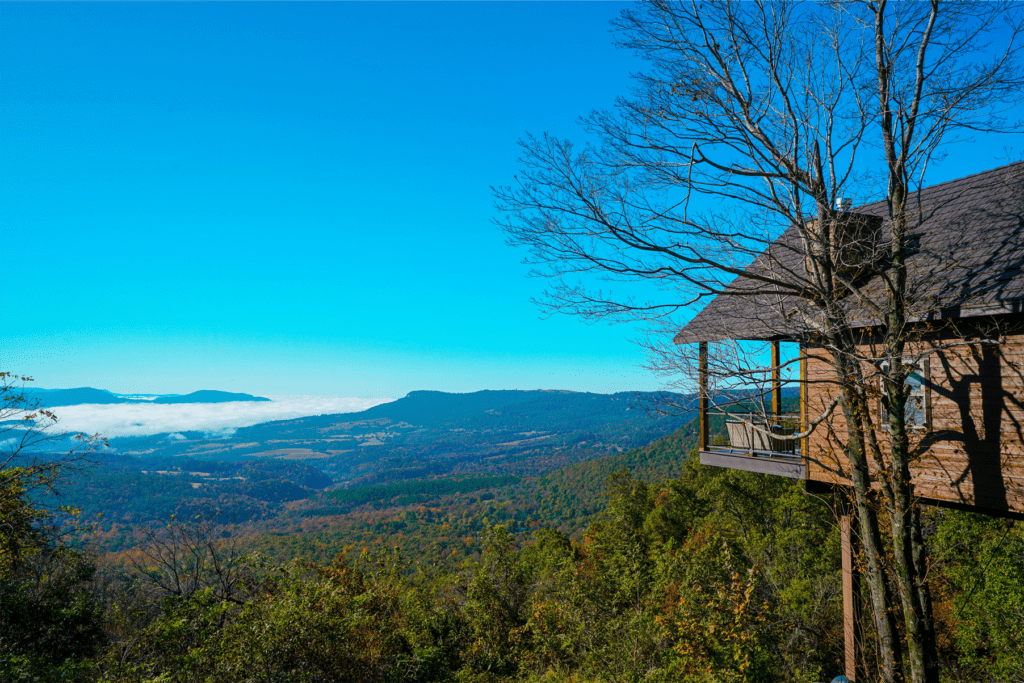

Specialize in Your Strategy The best way to win in real estate investing is often becoming an expert in a niche or specific focus. Easy Street Capital has tailored DSCR loan programs specifically for Short Term Rental Investors and BRRRR Strategy investors, with the best and most flexible terms for each.

- For Short Term Rentals, we qualify income based on AirDNA, lend in all markets (including seasonal and tertiary ones) and offer enhanced pricing for experienced professionals.

- For BRRRR investors, we can do the hard money loan for purchase in-house (not just the DSCR refinance), offer a cash-out of 100% of your proceeds in as little as 3 months and don’t require a long-term lease prior to refi!

Flexible Common-Sense Underwriting Easy Street Capital believes in a common-sense approach to underwriting, including using the higher of two credit scores if you are investing with a partner, no minimum DSCR if the deal makes sense otherwise and finance properties up to 10 units!

Next Steps!

Ready to get started or simply learn more about our EasyRent DSCR Lending Program?

About the Author

- Short Term Rentals Investing Guide: Flagstaff, Arizona - July 2, 2024

- Investment Property Interest Rates – July 2024 Update - July 1, 2024

- Short Term Rentals Investing Guide: Orange County, California - June 24, 2024

Stay in the Loop

Subscribe to our newsletter