Wisconsin Recent DSCR Fundings

Real Investments. Real Results.

Real estate investors in the Badger State are turning to DSCR Loans as a strategic tool to expand and manage their investment property portfolios. DSCR loans allow investors to secure financing based on the property's ability to generate income (rather than an investor's individual credit profile). In a market like Wisconsin, where real estate prices have shown steady growth and rental demand remains steady, DSCR loans offer investors a flexible and effective means to acquire new properties, improve existing ones, or refinance their assets. Easy Street Capital is proud to be a leading provider of DSCR loans for Wisconsin real estate investors looking to build rental portfolios! Check out our most recently funded DSCR loans in Wisconsin below:

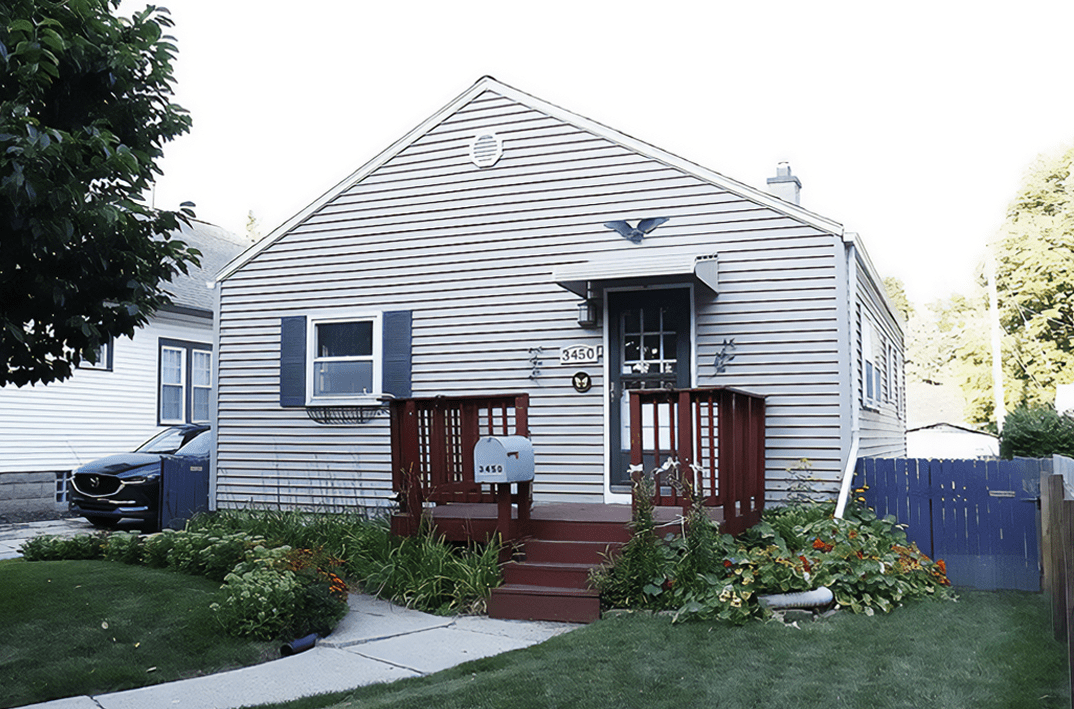

Single-Family Residence

Milwaukee, WI

$206,250 Wisconsin DSCR Rental Loan for a Cash-Out Refinance of a rental property in Milwaukee. Situated on a tranquil residential street with convenient access to local traffic arteries, its strategic location provides easy reach to schools, shopping centers, recreational facilities, and highways.

Single-Family Residence

Oshkosh, WI

$150,000 Wisconsin DSCR Rental Loan for a Acquisition of a rental property in Oshkosh. Located in a well-established residential market and a block away from Lake Winnebago, the property is nearby public schools and transportation, shopping, employment, and recreational facilities.

Quadplex

Milwaukee, WI

$180,710 Wisconsin DSCR Rental Loan for an Acquisition of a rental property in Milwaukee. Situated about five miles outside of Downtown Milwaukee, it is conveniently located within close proximity to various places of employment, healthcare facilities, schools, and a multitude of retail amenities.

Apply Today

Take the next step in your investment journey with a trusted, reliable lender that has your best interest in mind. Get in touch or request a quote today.