Fix and Flip Loans Guide:Everything You Need to Know About Fix and Flip Loans!

Easy Street Capital provides fix and flip loans for investors purchasing residential properties. Whether you are looking to buy and renovate a property or need a bridge loan, EasyFix is the easiest and fastest loan program in the country. We provide approval in less than 24 hours, can close your loan in 48 hours, and do not require an appraisal. We've designed our loan program to provide clear loan terms upfront and save borrowers time and money.

What is a Fix and Flip Loan?

A fix and flip loan, also known as a rehab loan, renovation loan, or bridge loan, is a type of short-term financing specifically designed for real estate investors who aim to purchase properties, renovate or “fix” them, and then quickly sell them for a profit of “flip” them. These loans provide funding for the acquisition, rehab, and carrying costs of the property during the renovation period.

Fix and flip loans are also known as hard money loans, which refer to a type of financing that is provided by private individuals or non-traditional lenders rather than conventional financial institutions. Often used in real estate investing, these loans are secured by the value of the property itself. Qualification focuses less on the borrower’s creditworthiness and more on the collateral – the property being purchased and/or renovated.

Fix and flip loans are accessible to borrowers with less-than-perfect credit or who may not meet the stringent requirements of traditional lenders. These loans are known for their speed and flexibility, featuring a streamlined application process and quicker approval times in comparison to conventional financing. Fix and flip loans provide real estate investors with an alternative source of capital, allowing them to seize opportunities, fund renovation projects, and ultimately generate returns in the competitive real estate market.

Are you new to fix and flip investing? Click the link below to check out our Fix and Flip Loans for Beginners article for a quick crash course in this popular investment strategy!

Why do People use Fix and Flip Loans?

Investors utilize fix and flip loans as a financial tool to facilitate their real estate investment strategies. Fix and flip loans enable investors to access the capital needed to purchase properties, cover renovation expenses, and carry out improvements necessary to enhance the property’s value and market appeal. The expedited funding allows investors to act swiftly in competitive markets and take advantage of time-sensitive opportunities. Overall, these loans provide investors with the financial means to execute their fix and flip strategies, leveraging their expertise and resources to generate profits in the dynamic real estate industry.

Key Pieces to a Fix and Flip Loan

The key components of a fix and flip loan that investors must keep in mind include fast funding, the valuation method as it relates to the property, what rates to expect, creditworthiness, renovation funding, and repayment structure.

Fast funding is the most significant advantage the fix and flip loans offer prospective investors. In a quick-moving, competitive real estate market, fix and flip loans allow investors to take advantage of time-sensitive opportunities as soon as they arise.

Another critical factor to keep in mind as it relates to fix and flip loans is how the value of a property is determined. Lenders assess the potential value of a property after you've completed repairs rather than valuing the property as it is presently.

Since the primary focus from a lender's perspective is the property rather than the individual, those with less-than-perfect credit or limited history can frequently qualify without issue.

As an essential piece of the fix and flip process, funding for renovations is typically included in the loan itself (alongside financing for the acquisition of the property). In terms of repayment, borrowers can expect to pay interest-only payments monthly with a balloon payment at maturity. Investors should expect these loans to have higher interest rates compared to conventional loans.

Fix and Flip Loans: Key Phrases to Understand

To successfully execute this strategy, investors should have a firm understanding of these three essential metrics: After-Repair Value, Loan to Cost, and Loan to Value. Familiarize yourself with these and other important terms in our Fix and Flip Loans Glossary!

Tips for Negotiating a Fix and Flip Loan

While every borrower, deal, and property is unique, there are a few general rules of thumb that investors should follow when it comes to negotiating a fix and flip loan. First and foremost, investors should seek to understand their needs. How much money is needed to complete their project? What loan structure and terms align best with their situation?

After an investor determines their needs, they should research potential fix and flip lenders thoroughly. Attending networking events and participating in your local real estate community can help forge and strengthen relationships with lenders.

In the process of securing a fix and flip loan, investors need to highlight relevant experience - proving you've fixed and flipped a property previously increases your chances at more favorable loan terms. When negotiating rates and fees, however, it is important to remain realistic and reasonable in your expectations. It will ultimately be a balance between your desired outcome in terms of your fix and flip loans and what the lender is comfortable with financing.

Finally, you should always review the loan agreement. Understand what you're signing! While this sounds like common sense, you would be surprised how many investors don't take these steps.

How to Know if you have a Good Loan for Your Project

How can you tell that your fix and flip loan is suitable for your project?

The answer lies in evaluating the terms of the loan, assessing the lender you intend to borrow from, and having a firm understanding of your overall plan. When looking at the terms of your fix and flip loan, you consider everything, including the loan amount, interest rate, and loan term.

Beyond the structure, you should also know the key metrics of your fix and flip project. What's the loan-to-value ratio? What's my expected after-repair value? You should always actively evaluate your relationship and interactions with the fix and flip lender you use. What is their reputation in the industry? Have they been open and transparent in their communication with you?

Finally, you should have an exit strategy. When the loan reaches maturity, where do you want to be, what steps can you take to get there, and how does your fix and flip loan fit this plan?

Having a thorough understanding of both your overall goal for a project and what you need to get there will set you up for successfully executing your flip.

Fix and Flip Loans: Your Project from Start to Finish

Preparing a project plan is essential when seeking a hard money investment for your real estate project. Start by conducting thorough market research to identify potential investment opportunities and determine the viability of your project. Define your project goals, including the type of property, target market, and desired returns. Develop a detailed scope of work outlining the specific renovations or improvements needed. Create a comprehensive budget, considering all project costs, including purchase price, renovation expenses, holding costs, and contingency funds. Prepare a timeline that outlines the project’s milestones and key deadlines. Gather all necessary documentation, such as property information, financial statements, and a compelling investment proposal. Finally, prepare to present your project plan to potential hard money lenders, highlighting its profitability and mitigating risks. A well-prepared project plan demonstrates your competence as an investor. It increases your chances of securing a hard money investment for your real estate project.

Check out our “Rules to Flip By” for additional tips on how to ensure you have a successful investment experience.

After completing a fix and flip project, there are several vital steps to take to ensure a smooth transition and maximize your investment returns. First, focus on marketing and selling the renovated property. Utilize effective marketing strategies such as online listings, professional photography, and staging to attract potential buyers. Work with a real estate agent or explore direct selling options to expedite the sale process. Once you secure a buyer, proceed with the closing process, ensuring all necessary legal and financial documentation is in order. Next, calculate your overall investment performance, taking into account the initial purchase price, renovation costs, loan interest, and associated fees. Evaluate the profitability of the project by comparing the final selling price to the total investment.

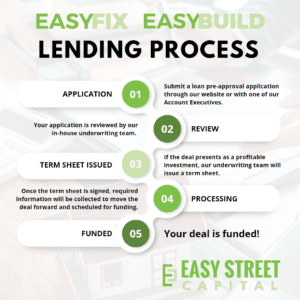

Our Fix and Flip Lending Process

EasyFix is the perfect short-term solution for investors looking to renovate investment properties. With closings in as little as 48 hours, investors can focus on winning deals and less time on underwriting red tape. Our process allows investors to avoid the mountains of endless paperwork and intrusive document-gathering common with our competitors. We do not require tax returns or income verification, ask for years of bank statements, or many other typical requests from other lenders. Easy Street Capital is committed to a stress-free lending process with a team that brings years of fix and flip experience to the table.

Additional Fix & Flip Loan Resources

Are you interested in learning even more about fix and flip loans? Check out some of these additional resources on our site!

Our Services & Solutions:

EasyFix - Easy Street Capital's industry-leading financing solution for fix and flip investment properties.

View our recent Fix & Flip Fundings - A collection of some of our favorite deals we've funded recently!

Blog Posts & Resources:

Fix and Flip Loans for Beginners - Information for new real estate investors to learn about fix and flip loans.

Fix and Flip Loans for Experienced Investors - Information about fix and flip loans for more experienced real estate investors.

Fix and Flip Key Metrics: ARV, LTV & LTC - Learn more about the three most important metrics for fix and flip loans.

Best Markets for Fix and Flip Investments - Our top picks for the best fix and flip markets.

What to do When Your Flip Won’t Sell - Discover your options when you can't sell the property you intended to flip.

Read About Our Borrowers:

Borrower Spotlight: Austin Investor Tells First Flip Success Story