New Construction Loans Guide:

Everything You Need To Know About GUC!

Easy Street Capital's EasyBuild loan program is built for investors tackling new build or ground-up construction projects. From land acquisition to final construction, builders can acquire fast, flexible financing with closings in as quick as 48 hours. No complicated hurdles—just an easy process with clear terms. Our team supports you in every step to ensure your project moves forward without delay.

What is a New Construction Loan?

A new construction loan is a type of short-term financing specifically designed for real estate investors looking to build properties from scratch. These loans provide funding for the acquisition of land, materials, labor, and other expenses related to constructing a new property. Unlike traditional mortgages, new build loans are tailored to cover the costs of any and every step of the building process.

New construction loans, also known as ground-up construction loans, new build loans, bridge loans, or hard money loans, refer to financing provided by private lenders rather than banks. Secured by the property's value, these loans prioritize collateral over the borrower's credit score. This makes them ideal for individuals with imperfect credit or those who don't qualify for conventional options. With a fast approval process and flexible terms, home building loans empower investors to act quickly in the ever-changing real estate market.

At Easy Street Capital, we offer specialized programs like EasyBuild for new construction projects and EasyFix for fix-and-flip ventures. We provide quick, accessible capital for your real estate goals.

New to this investment strategy? Check out our beginner's guide by clicking the button below for a quick course in construction financing!

Why Do People Use Ground-Up Construction Loans?

Investors rely on new construction loans as an essential financial tool to drive their real estate investment strategies in ground-up construction and new build projects. These construction financing options provide the capital required for land acquisition, building costs, and managing the entire development process. With expedited funding, investors can move efficiently in competitive markets and seize market opportunities that demand quick action. Ultimately, new construction loans equip investors with the necessary resources to execute their property development visions and harness their expertise to maximize real estate profitability in a fast-paced industry.

Key Pieces to New Construction Financing

When exploring financing options for a construction project, understanding the key aspects of ground-up construction loans is essential for investors of all levels. These loans offer unique benefits tailored to constructing investment properties.

One of the standout advantages of new build loans is their fast funding. In today's competitive real estate market, timing is everything. These loans provide investors with rapid access to capital; they enable builders to secure land and begin construction without delay.

Unlike traditional loans that assess a property's current worth, construction loans hinge on the projected value of the completed project. New construction lenders evaluate what the property will be worth once construction is finished by factoring in plans, permits, and market trends.

A key feature of new build loans is their all-in-one funding structure. These loans typically cover both the cost of purchasing land and the expenses tied to construction.

The repayment terms for construction loans often involve interest-only payments during construction, followed by a balloon payment or refinancing options once the project is complete. Construction loan rates are typically higher than conventional loans because of their short-term structure, but the difference is small.

New Construction Loans: Key Phrases to Understand

To successfully execute this strategy, investors should have a firm understanding of these three essential metrics: After-Repair Value, Loan to Cost, and Loan to Value. Familiarize yourself with these and other important terms in our Hard Money Glossary!

Tips for Negotiating a Construction Loan

While every borrower, deal, and property is unique, there are a few general rules of thumb that investors should follow when it comes to negotiating a new construction loan. Start by calculating the full scope of your project's costs—land, materials, labor, permits, and more. Then, decide on a loan structure that fits, like a draw schedule where funds are released as construction progresses.

After an investor determines their needs, research lenders who specialize in construction financing. Attend industry events or connect with your local real estate network to build relationships with those in the know.

If you've successfully completed construction projects before, highlight that track record to strenghten your position. It can help increase your credibility and secure better loan terms. However, be realistic during negotiations: construction loans often carry higher interest rates due to their inherent risks. Aim for a balanced agreement that satisfies both you and the lender by focusing on terms that align with your project.

Finally, before signing, you should always review the loan agreement. Double check the details—draw schedules, inspection rules, and completion deadlines—to avoid surprises later.

How To Know If You Have a Good Loan For Your Project

How can you tell if your ground-up construction loan is suitable for your project?

The answer lies in evaluating the terms of the loan, assessing the lender you intend to borrow from, and having a firm understanding of your overall project plan. You will need to look into key details such as the loan amount, interest rate, draw schedule, and loan term.

Beyond the loan's structure, you should also understand the key metrics of your real estate development project. For instance, what's the loan-to-value (LTV) ratio based on the projected value of the completed property? These figures help you gauge whether the loan aligns with your financial goals and project's potential profitability.

Actively evaluate your relationship with the construction / hard money lender. What's their reputation in the industry for handling new construction loans? Have they been transparent and communicative throughout the process? Choosing a reliable lender with experience in ground-up construction loans can make a significant difference in ensuring smooth funding and support during the build.

A clear exit strategy is crucial. When your loan reaches maturity, where do you want to be—selling the completed property, refinancing into a long-term mortgage, or holding it as a rental? Consider the steps required to achieve your goal and how the loan terms support the plan. A well-aligned loan will provide the flexibility and resources needed to execute your vision.

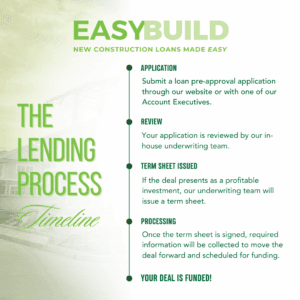

Our Construction Lending Process

EasyBuild is the perfect short-term financing solution for investors looking to fund new construction projects. With closings in as little as 48 hours, investors can focus on acquiring land and breaking ground, rather than navigating complex underwriting hurdles. Our process is designed to minimize paperwork and eliminate intrusive document requests—no tax returns, income verification, or piles of bank statements required. At Easy Street Capital, we prioritize a smooth, stress-free lending experience for investors of all experience levels, supported by a team with deep expertise in new construction financing.

Additional Ground-Up Construction Resources

Are you interested in learning even more about ground-up construction loans? Check out some of these additional resources on our site!

Our Services & Solutions:

EasyBuild - Easy Street Capital's industry-leading financing solution for new construction investment properties.

View Our Recent New Construction Fundings - A collection of some of our favorite deals we've funded recently!

Blog Posts & Resources:

New Construction Loans for Beginners - Information for new real estate investors to learn about ground-up construction loans.

Ground-Up Construction FAQs - Get answers to the most frequently asked questions about our new counstruction EasyBuild loan program.

Choosing the Best Hard Money Lender for New Construction Builds - Learn how to select the right hard money lender for your construction project.

Reasons to Invest in New Construction - Find out why you should be investing in new construction in 2025.

Apply Today

Take the next step in your investment journey with a trusted, reliable lender that has your best interest in mind. Get in touch or request a quote today.